Trial Balance is an announcement that lets you verify the accuracy of your ledger accounts. This is as a outcome of it not solely helps in determining the final position of various accounts. Then, you steadiness each account when you report all of the transactions within the ledger. Following this, you put together a Trial Balance statement utilizing balances from every of the ledger accounts. The very function you prepare a trial steadiness is to confirm the correctness of your double-entry bookkeeping.

This coaching additionally supports skilled development and reduces dependency on exterior consultants or auditors. The stability of an account may be decided simply by summing up the debits and credit within that account for a given interval. The quantity resulting from this sum will indicate whether or not the account has a debit or credit stability.

It is usually launched to the general public, rather than just being used internally, and requires the signature of an auditor to be considered trustworthy. Accounting software program like QuickBooks On-line can handle the heavy lifting—posting transactions, generating trial balances, and preserving your data accurate behind the scenes. That means much less time on knowledge entry and extra time targeted on rising your corporation.

Closing Fairness Ledger Account

Clear also can help you in getting your small business registered for Goods & Providers Tax Law. Simply addContent your kind 16, claim your deductions and get your acknowledgment number online. You can efile earnings tax return on your income from salary, house property, capital features, enterprise & profession and earnings from different sources. Further you can even file TDS returns, generate Form-16, use our Tax Calculator software program, claim HRA, check refund status and generate hire receipts for Revenue Tax Submitting.

Watson Electronics Ledger Accounts

It is a component of the double-entry bookkeeping system that provides a basis to monetary statements’ accuracy. Keep in mind, this does not make sure that all journal entries have been recorded accurately. Such a abstract lets you locate journal entries within the unique books of accounts. For occasion, your company’s trial steadiness sheet offers an audit trail to the auditors.

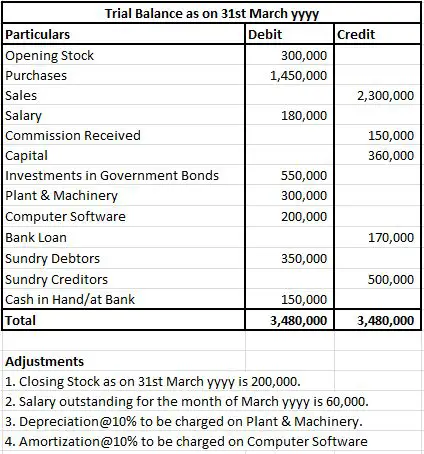

This is because there are some errors that wouldn’t have an impact on the equality of the debit and the credit score columns. Nonetheless, you must notice that simply tallying the trial stability accounts does not imply that your accounts are accurate. It simply implies that the debit and the corresponding credit score of various monetary transactions have been recorded correctly in the general ledger. Therefore, Trial Balance is a crucial accounting statement because it showcases the ultimate status of each of your ledger accounts on the finish of the financial year.

Committing such an error will surely influence your monetary statements. That is, such an error would lead you to understate or overstate income, belongings, liabilities, etc. Say for example Watson Electronics paid $25,000 to Bob & Co who is the supplier of products. Nevertheless, you debit Bob & Co’s account with $2,500 solely whereas posting this transaction to the final ledger. The trial stability does not record every transaction your small business made underneath the accounts.

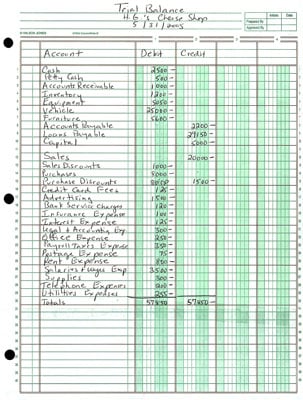

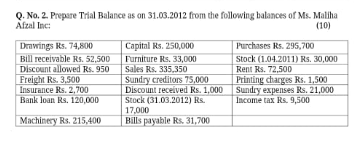

Earlier Than you probably can prepare a trial steadiness, it is crucial to have the general ledger so as. The common ledger serves because the master record of all monetary transactions categorized by account. Every transaction from the journal is posted to the related ledger account, such as cash, inventory, accounts payable, or sales income https://www.simple-accounting.org/. These ledger entries have to be accurate and updated before trying to compile the trial steadiness.

Evaluating Trial Balances And Stability Sheets

Bear In Mind, accounting errors happen at any one of the stages of the accounting process. Additional, you should put together fundamental financial statements like the income statement and balance as quickly as the accounts are tallied in the trial steadiness sheet. One of the primary things a trial balance does is act like a pink flag for errors in your books. If the entire debits and complete credit don’t match in your trial stability, one thing is off and needs to be fastened. This mismatch alerts you that an entry was recorded incorrectly and must be corrected earlier than transferring ahead.

- Preparing the trial steadiness completely ensures that the final accounts are error-free.

- For instance, your purchases account would showcase an extra debit of $10,000 if you overstate your purchases in the books by $10,000.

- The balances of those accounts are then used to arrange the trial steadiness.

- Nonetheless, the balancing of your trial balance doesn’t imply that your accounting data are correct.

- Earlier Than you make adjusting entries for accruals, deferrals, or corrections, you want an accurate trial balance.

For belongings, this means that cash is listed first, followed by accounts receivable, stock, and stuck belongings. Correct ordering aids in readability and makes the transition to financial statements more seamless. In the mixed method, we record both the entire debits and credits, as nicely as the ending balances. Assume that the next ledger account has complete debit and credit score at the finish of an accounting period. This methodology is never used as a end result of the only requirement for preparing financial statements is the net stability of the ledger account.