Now imagine a lawsuit legal responsibility is possible but unlikely, with an estimated quantity of $2 million. In this case, the corporate discloses the liability in the monetary assertion footnotes. If the firm determines that the probability of the legal responsibility occurring is remote, the corporate does not need to disclose the potential liability. Product warranties are a common example of contingent legal responsibility, the place a company creates a legal responsibility for potential costs of repairs or replacements under the guarantee. This is typically recorded by debiting Warranty Expense and crediting Warranty Legal Responsibility.

This rollforward schedule should distinguish amounts reversed and unused from amounts used. These quantities are computed declare by claim and can’t be netted towards different provisions will increase or decreases. For a authorized declare, a significant consideration could be the associated prices that a company expects to incur – e.g. lawyers’ and experts’ fees. Nonetheless, underneath US GAAP, the accounting for associated legal prices is topic to an accounting policy election.

Aside from reserves, the mere determination whether to reveal pending litigation in monetary statements can also have main financial and authorized ramifications. Moreover, both public and nonpublic firms are affected as a end result of each should correctly account for and disclose litigation loss contingencies to adjust to Typically Accepted Accounting Principles (GAAP). This is completely different from the final journal entry, the place dangerous debtwas estimated at $58,097. That journal entry assumed a zero balancein Allowance for Doubtful Accounts from the prior interval. Thisjournal entry takes into account a debit balance of $20,000 andadds the prior period’s balance to the estimated stability of $58,097in the present interval.

Grasp the fundamentals of economic accounting with our Accounting for Monetary Analysts Course. This comprehensive program presents over 16 hours of expert-led video tutorials, guiding you thru the preparation and analysis of income statements, balance sheets, and cash move statements. Gain hands-on experience with Excel-based financial modeling, real-world case studies, and downloadable templates. Upon completion, earn a recognized certificate to reinforce your profession prospects in finance and investment. The very nature of this uncertainty presents challenges in determining when to acknowledge a provision and tips on how to measure it.

A contingent legal responsibility is a potential legal responsibility that will occur sooner or later, such as pending lawsuits or honoring product warranties. If the liability is more likely to occur and the quantity may be moderately estimated, the legal responsibility ought to be recorded within the accounting information of a firm. If important to the financial statements, provisions for losses are proven as a separate legal responsibility on the steadiness sheet. Contingent liabilities ought to solely be recorded within the accounts when a possible future event is likely to happen and the amount can be moderately estimated. This is often done within the notes to the accounts, not in the primary monetary statements. If a contingent liability is recorded, it goes to be journalized as a loss or expense within the assertion of revenue and loss, and a liability in the stability sheet.

Q: How Does Trust Accounting Apply To Lawsuit Settlements?

Warranty bills can also be thought-about a contingent legal responsibility, as they’re costs which could be incurred in the future to restore or substitute a product. If the possibilities of a contingent legal responsibility are possible however not more doubtless to arise quickly, and estimating its value just isn’t attainable, it isn’t recorded in the financial statements. If it’s probable that a legal responsibility will come up, you may must document it within the monetary statements. A contingent legal responsibility is a kind of liability that will occur in the future because of an occasion that has already taken place. It Is a possible obligation that’s unsure and dependent on future circumstances. Contingent assets are assets which may be prone to materialize if certain occasions arise.

However, if the chances of a contingent legal responsibility are attainable however not more doubtless to arise quickly, estimating its value isn’t potential, and it should only be disclosed in the footnotes of the monetary statements. They consider that a loss is possible and that $800,000 is an affordable estimation of the amount that can eventually should be paid because of this litigation. Though this steadiness is just an estimate and the case may not be finalized for a while, the contingent loss is acknowledged, as can be seen in Determine https://www.simple-accounting.org/ thirteen.7 “Year One—Expected Loss from Lawsuit (Contingency)”. Underneath GAAP, corporations are usually prohibited from recognizing achieve contingencies in financial statements till they’re realized. Reserving funds for possible litigation losses may significantly affect reported earnings. Worse, failing to e-book applicable reserves could lead to restatements of earnings, which might invite an SEC investigation or shareholder litigation.

Irs Tips On Settlement Payments

The GAAP pointers require that loss contingencies be recorded in an organization’s monetary statements if the loss is likely and can be reasonably estimated. As of January 1, 2018, GAAP requires a change in how health-careentities record unhealthy debt expense. Before this change, theseentities would document revenues for billed providers, even when theydid not anticipate to collect any cost from the patient. Then all of thecategory estimates are added together to get one complete estimateduncollectible stability for the interval. The entry for unhealthy debt wouldbe as follows, if there was no carryover balance from the priorperiod.

- The potential liabilities whose occurrence depends on the result of an unsure future event are accounted for as contingent liabilities in the monetary statements.

- The Corporate is topic to varied legal proceedings, claims, and regulatory actions arising within the ordinary course of enterprise.

- In inside P&L reviews, settlement payments are often shown in a “cash P&L” section.

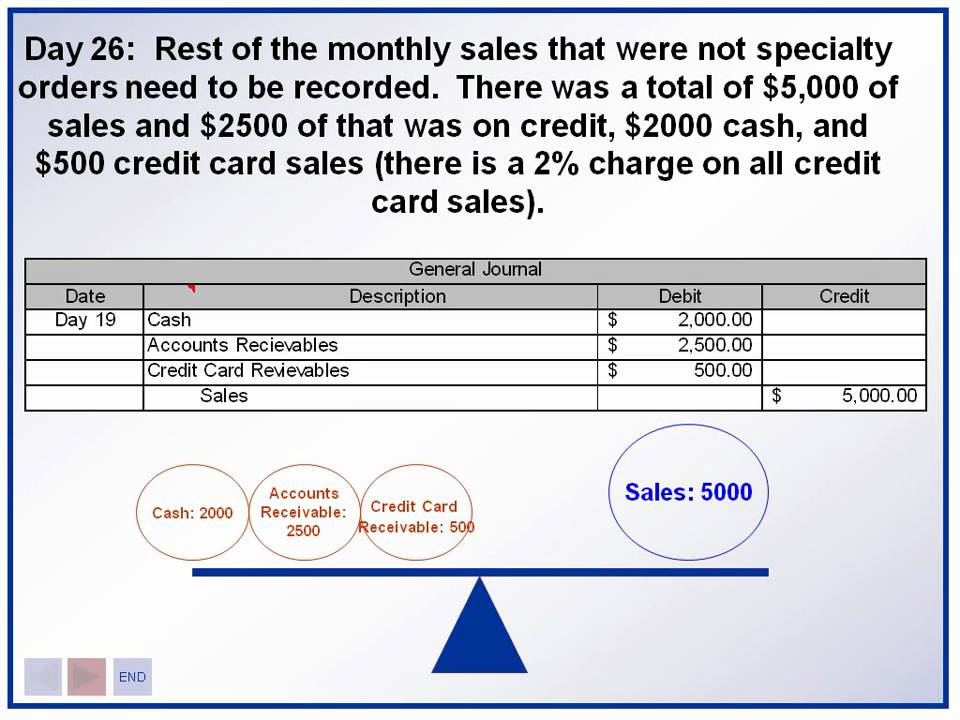

- Setting up a ledger in a legal apply administration platform, Excel, or accounting software like QuickBooks may help navigate the complexities of GAAP requirements for lawsuit proceeds and settlements.

According to the FASB, if there’s a possible liabilitydetermination before the preparation of financial statements hasoccurred, there’s a chance of occurrence, andthe legal responsibility must be disclosed and acknowledged. This financialrecognition and disclosure are acknowledged in the current financialstatements. The earnings assertion and stability sheet are typicallyimpacted by contingent liabilities. Authorized damages or settlements are sometimes recorded as features or losses on a company’s earnings assertion. If the lawsuit is not over but the company plans to pay out, it might be necessary to report the loss as a contingent liability. The accounting treatment depends on the character of the litigation and the related positive aspects.

Since the legal responsibility is probable and simply estimated, the agency information a $2 million accounting entry on the stability sheet, debiting authorized expenses and crediting accrued bills. Pending lawsuits and product warranties are frequent examples of contingent liabilities as a end result of their unsure outcomes. Reporting a contingent liability depends on its estimated dollar amount and the probability of the occasion. The accounting rules ensure that financial statement readers receive adequate data.

The contract worth is $1,000,000 and the estimated whole contract cost is $800,000. When deciding upon the appropriate accounting for a contingency, the fundamental idea is that you should solely document a loss that’s probable, and for which the quantity of the loss could be reasonably estimated. If one of the best estimate of the quantity of the loss is within a spread, accrue whichever amount appears to be a better estimate than the opposite estimates within the range.